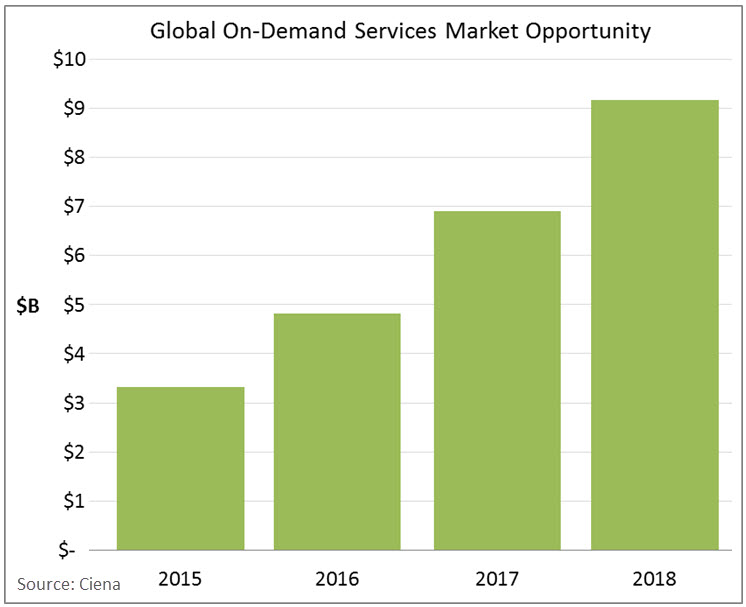

The $9B Market Opportunity for On-Demand Services

Niloufar Tayebi is a Senior Advisor in Ciena’s Global Industry Marketing team, focused on helping service providers find new revenue streams from their networks through on-demand and other value-add services.

Niloufar Tayebi is a Senior Advisor in Ciena’s Global Industry Marketing team, focused on helping service providers find new revenue streams from their networks through on-demand and other value-add services.

This is the third in a series of blog posts focusing on BoD and on-demand services. Other posts in the series:

For years now, our industry has discussed the growing need for dynamic on-demand network services. For example, we’ve recently seen NTT announce on-demand and usage-based pricing for network services up to 1G. This trend will continue in the market, informing the on-demand and usage-based pricing of network connectivity services.

One of the main questions, however, is the size of the market: How big is this opportunity for service providers? Ciena has an answer! We estimate that the potential size of the on-demand Optical and Ethernet services market is $3 billion – not in 5 or 10 years, but right now.

For 2015, we estimate that $3 billion of the static market could shift to the on-demand market if more service providers were to offer on-demand services – and that by 2018 this figure will exceed $9 billion.

So now let’s back-up those numbers with some data. We arrived at those figures by using two approaches, one based on the size of the existing Ethernet and Optical services markets, and one based on the relation to the cloud services market. Here are the details:

Estimation based on Optical and Ethernet services markets

To calculate this estimation, we used the total size of the Optical and Ethernet services market. Let’s start with the Ethernet services market, which currently equates to approximately $50 billion and includes both wholesale and enterprise/retails services, as indicated by approximate projections from research and analysis firms Ovum, Vertical Systems, and Infonetics.

By adding the Optical wavelength services market projection from Frost & Sullivan to this initial figure, the global Optical and Ethernet services market, which is currently growing at a healthy rate, is expected to reach $58 billion by 2016. Not only that, but the Carrier Ethernet services market shows a 12% CAGR, with forecasts reaching $70 billion by 2018.

In previous posts, we discussed the benefits of offering on-demand services to enterprises who are stuck at lower bandwidth rates and are experiencing less-than-ideal static services performance due to the contractual nature of service offers and the lengthy lag time to provision. Assuming a gradual uptake and transition of these static connectivity services to on-demand services of just 5–7% between 2015 and 2016, and an additional 10–12% between 2017 and 2018, the market for on-demand services will reach approximately $9 billion by 2018.

Therefore, approximately $9 billion could shift from static Optical and Ethernet services to on-demand by 2018.

Estimation based on analogy to the size of cloud services market

Now that we’ve seen how to carve out a slice of the overall static services market using an estimation based on Optical and Ethernet service markets, let’s take a look at an estimation of on-demand services spending as it relates to overall estimated enterprise cloud storage and compute spending.

Why do we do this? Because the major opportunity for on-demand connectivity services directly relates to the delivery of cloud compute and storage services, also referred to as Infrastructure-as-a-Service or IaaS. For the average enterprise today, the cost of cloud connectivity is at least equal to – or upwards of 1.5 times greater than – the cost of cloud computing and storage.

![]()

By looking at predicted enterprise spending for cloud compute and storage services (IaaS) over the next few years, we can extrapolate potential spending on cloud connectivity.

- Estimates for the total IaaS market fall in the $13 billion range for 2014, growing to upwards of $31 billion by 2017 (about 40% CAGR).

- Of that market, approximately 30% is spent on actual cloud compute and storage, with the remainder comprised of co-location space and power costs, which are not included in our calculations.

The result is a spending amount of approximately $10 billion on cloud compute and storage services for 2017, and with a 1.0X to 1.5X factor for connectivity services you can easily see how the total on-demand services opportunity could be at least $10 billion – if not more.

These two estimation methods nicely correlate to each other, which justifies our view of this market potentially passing the approximately $9 billion mark in 2018.

As this market forms, we will see more analysis and reports that support our current estimation of $9 billion by 2018. Ciena welcomes the opportunity for dialog on this topic – we’ll need to work together with our service providers and network connectivity providers to create and expand the market for on-demand connectivity services.