Roy Rubenstein, Consultant at LightCounting Market Research, outlines the challenges and opportunities CSPs face amid ongoing market competition and technological changes, and the critical role of network transformation to enhance revenue and operational efficiency.

Roy Rubenstein is a consultant at LightCounting Market Research. Rubenstein has been a consultant at LightCounting for over 15 years. His topics of coverage include telcos and photonics. He is also the publisher of Gazettabyte, an online magazine focused on the telecom, datacom, and chip industries, and co-author of a book on Silicon Photonics.

Communication Service Providers (CSPs) are experiencing a period of significant and continual change. They are seeking new revenue opportunities while operating in fiercely competitive marketplaces.

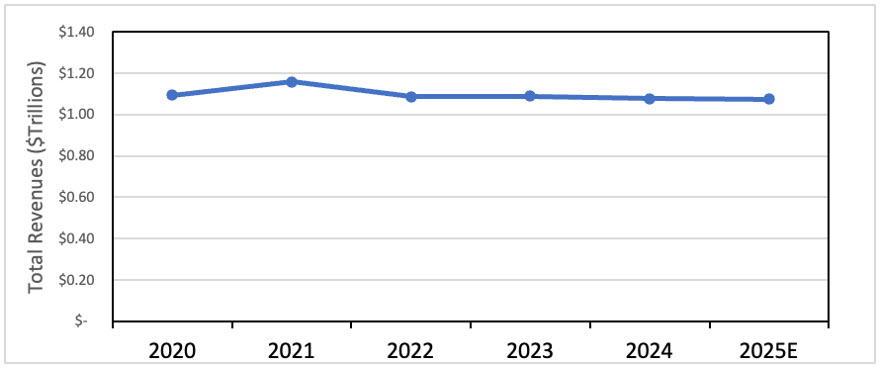

Telecoms is also a capital-intensive industry, meaning CSPs must invest in their networks to remain competitive yet are seeing only marginal growth. LightCounting tracks the revenues of the 15 leading global telcos, and their sum totals have remained stubbornly flat for several years, see Figure 1.

Figure 1. Total yearly summed revenues of the 15 leading telecom service providers. Source: LightCounting.

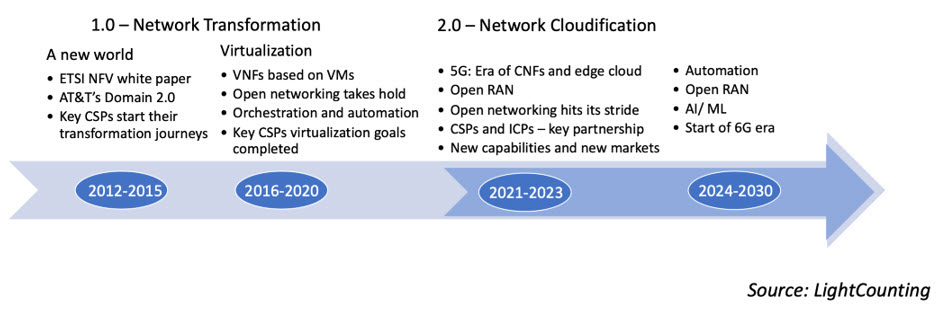

The CSPs' desire for revenue growth is not new. The starting gun sounded in 2012 when 13 leading global operators issued an ETSI White Paper to rally the industry to build networks differently. The operators had witnessed the cloud service providers' agility and business success using off-the-shelf hardware and modern software practices. The telcos wanted such flexibility for their networks. Since then, operators have embraced new technologies and practices, as shown in Figure 2 below.

Figure 2. The network transformation stages and key technologies: 2012 to 2030. Source: LightCounting.

Fast forward to today, the focus is now on 5G, fiber, Artificial Intelligence (AI), and driving greater network automation. Operators want to offer their networks as platforms to serve industries undergoing their own digital transformations. That said, each operator's transformation journey is unique. But a challenge they all share is dealing with legacy equipment in their networks.

Consider the example of a fixed network upgrade. Typically, the upgrade is sanctioned to add capacity to cope with traffic growth. Another cause can be to address increasingly frequent network failures due to aging equipment. Identifying culprit equipment can be challenging; even once located, staff may not have the know-how to address such legacy kit.

Another factor spurring network upgrades is security. Governments have mandated that operators strip out specific vendors' equipment in the US and certain European countries due to security concerns. In turn, aging equipment may no longer be supported with security patch updates, causing network vulnerabilities.

But addressing legacy equipment is tricky. Operators may not know the location of all the equipment delivering circuits. Operators may also not see the loading and the services carried on legacy kit. Nor is this just a fixed network issue. A telecom executive at a conference recently detailed how a European operator had approximately 14,500 radio sites. Staff no longer had the inventory associated with some of the older sites.

Network upgrades are an obvious opportunity to decommission older equipment, saving power and space and, hence, operational costs. Operators may even find they can decommission complete sites. Operators may also need to vacant sites, forcing the issue. It is here where systems vendors such as Ciena play a role.

Choosing the right partner for your transformation journey

A CSP looking for a system vendor partner should consider how broad their network transformation experience is and whether the partner understands the CSP's needs and can offer transformation options.

Another consideration is what software tools the vendor has. Such tools include the ability to analyze the network to identify existing network elements and circuits. The tool will need to work across vendors and different generations of platforms.

Most importantly, the vendor must be able to identify how best to migrate services, including decommissioning options for equipment and even sites. That said, vacating sites may be a key reason for the CSP's transformation work. Also, can the vendor's tools automate many of these steps?

CSPs vary in the degree of assistance they need from the vendor. Some prefer to do much of the work while others may be more stretched. How flexible is the vendor here? And what is their record in executing the transformation on time and with minimal risk to existing services?

The demonstrable transformation benefits? Extra network capacity, for one. The ability to turn up new services faster is another, in tens of days rather than several months. There are also operational cost savings in space and power. One example project successfully consolidated 70 legacy network elements across 8 sites down to just 9 modern elements on those same sites. This not only achieved an 87% reduction in space and a 73% reduction in power consumption but, critically, enabled a $2.5M capital expenditure saving by freeing up capacity that eliminated the need for planned power, HVAC , (heating, ventilation and air conditioning), and facility upgrades. For the operators, the end goal is to create an agile, end-to-end, AI-driven automated network. This will require streamlining the network and exposing networking data. None of this can be achieved without addressing legacy. CSPs also want to retire legacy copper access networks to meet sustainability targets. Such projects are considerable undertakings, requiring migration strategies across networking layers.

It should be assumed that vendor-assisted network transformation projects will be required for a while yet.

Join us for a webinar on July 17, 2025, as Roy Rubenstein, Consultant at LightCounting hosts Ciena’s VP and GM of Global Services, Greg Friesen, and Chris Harris VP Operations & Engineering at Iris Networks to discuss a real-world network transformation case study, examining the critical challenges encountered and the significant business benefits achieved. Gain actionable perspectives on planning and executing successful transformation projects. Register here.