Expanding business models of managed wave services with Adaptive Networks

100G wave services are the fastest growth managed wave service today

Let’s step back in time to take a snap-shot of what service interfaces have previously thrived in managed wave service offers. In a managed wave service, the service provider is able to offer a wide range of client service interfaces: Ethernet, SONET/SDH, DWDM, storage area networking (SAN) interfaces and more.

For these managed wave services, the client is handing off an interface that is required to transport payload connecting two data centers in complete transparency without protocol conversion. This is done by either using a dedicated wavelength over DWDM or through the use of OTN containers (aka ODU).

With the growth of traffic and cost-per-bit declining, client interfaces are now evolving to higher bit rates – as happened with the evolution from SONET/SDH clients to 10Gbps clients – but also expanding in client protocols that supported 10Gbps, such as ODU-2 and 10GE.

One natural path for evolving a managed wave service is to continue the path of offering higher rate, with more emphasis on 100GE and ODU-4 client interfaces. Today it is common to look at a managed wave service and see 100GE and ODU-4 /100Gbps clients supported. With the ongoing reduction of cost-per-bit and higher rate transport, offering managed wave services at higher than 100Gbps client support also makes economic and technical sense.

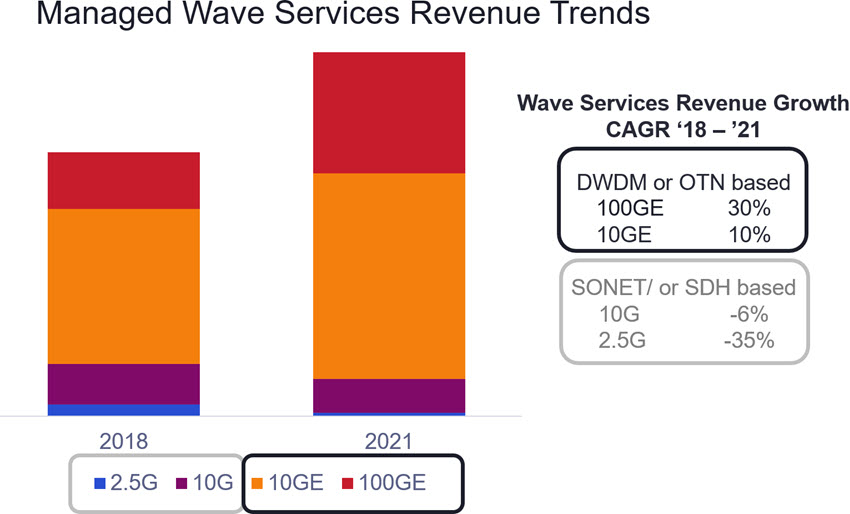

Ciena’s market intelligence and global consulting teams have been tracking the market size of managed wave services. Their findings show 10GEoDWDM managed wave services are mature services contributing to 60% of managed wave service offers, while 100GEoDWDM managed wave services are the fastest growing wave services at a 30% CAGR.

This revenue growth is driven by higher volume of the demand for these services, which more than offsets the yearly price erosion on services Monthly Recurring Charge (MRC) that these managed wave services experience. Furthermore, many providers differentiate their managed wave services with higher value services, such as including protection options enabled by OTN switching, enabling diverse paths and or upselling encrypted and secure wave services with optical encryption security features that can add higher value to the base wave service offers.

Managed optical networks – virtualized and dedicated forms

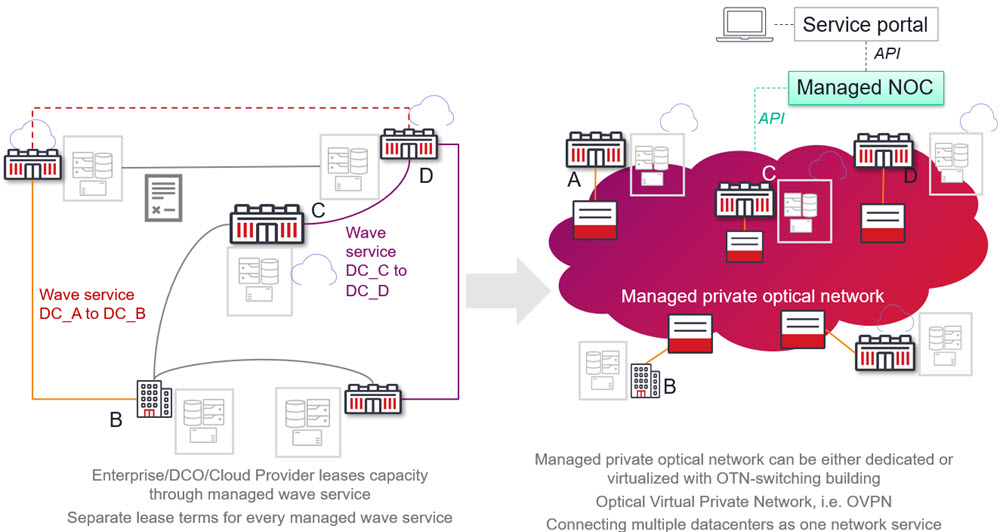

Many enterprises, data center operators or cloud providers with large amount of capacity and multiple data center locations consider leasing capacity in the form of multiple managed wave services in order to connect all of their data center cloud resources. For these enterprises, cloud resources within data centers and the network that connects them together act and perform like one.

These enterprises may have resources in a metro, several metros within a region, or internationally. The sheer amount of the connectivity required creates demand for many managed wave services. For example, a logical mesh connectivity built to interconnect these data centers can add up to hundreds of Gbps to Terabits of transport capacity.

As the enterprise relies upon carriers to connect their data center resource, often they lease capacity in increments of 10Gbps or 100Gbps in the form of a managed wave service. The challenge becomes managing the many disparate and variable contract terms that constitutes this type of business model of leasing capacity through separate 10Gbps or even 100Gbps managed wave services.

In such cases, it is desirable and preferred by the enterprise to consolidate these separate contracts in the form of one managed DCI service. This model is also desirable for the carrier or service provider as it enables the carrier to offer improved experience to the enterprise and to earn the transport business of their full DCI connectivity.

Historically these offers sparsely existed and were categorized as individual customer build (ICB). Now with the ability to use OTN-switching, ROADMs, and programmability at the optical layer, these ICB offers are evolving and service providers are finding new ways of monetizing the ICB projects. Promising business models are emerging in this space as carriers enable a programmable optical layer combined with software control and intelligence. What used to be sheer capacity management can be augmented with traffic steering/switching at the optical layer, improved planning, and an improved customer experience enabled by software control and analytics.

Spectrum sharing in terrestrial networks

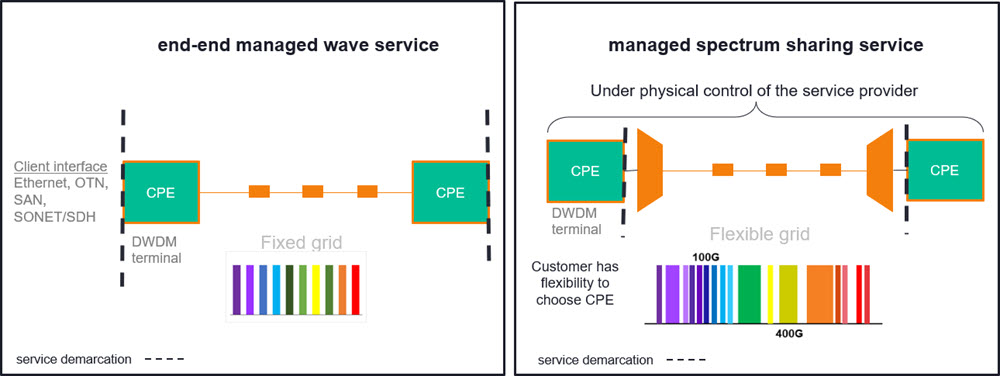

Cloud providers and content providers experiencing bandwidth growth are now investing in higher speed 100Gbps and, in the near future, 400Gbps ports. Demand for optical client-to line connectivity at 400Gbps rates exists and is driven by cloud providers who need many Tbps of capacity for DCI. According to Dell’Oro research published in ConvergeDigest, 400GE-interface switches and routers debuted in the market in 2018 and the expectation of industry analysts is for large cloud service providers like Amazon, Facebook and Microsoft to ramp-up 400Gbps ports in coming years.

This need for higher speeds creates another type of opportunity for Managed wave service providers. Rather than solely offering dark fiber, network operators and service providers who face demand for multiple 400Gb/s waves can consider offering a shared spectrum service, allowing them to monetize the sought-after dark fiber routes by ‘virtualizing’ the fiber with flexible spectrum offers.

This requires solutions in optical systems that support flexible grid and are programmable with software control and real-time analytics. Ciena’s WaveLogic Photonics solution, comprised of such elements as WaveLogic programmable coherent optics, CDC ROADMs and Manage, Control and Plan (MCP) software is one such solution. The solution’s analytics and software control allows network operators to plan, monitor and manage flexible portions of spectrum. In this offer, while network providers retain full physical control of equipment and are responsible for provisioning and management, users have the flexibility of choosing which DWDM transceiver technology they want to use, shown in the diagram below as the DWDM CPE, with the option of changing the transceiver technology over time. In this model, the managed service provider still has full control of the CPE from a provisioning and operations perspective to ensure network stability, as well as no impact to other services across the network.

Easier and faster to plan, design, provision and maintain wave services

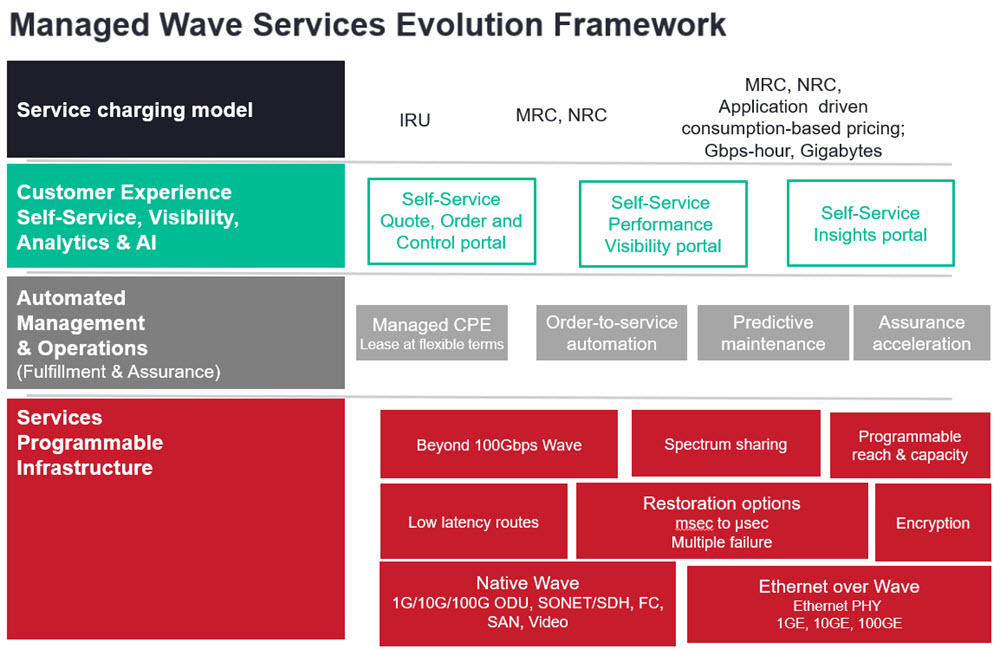

With the adoption of programmable networks and software control and APIs that facilitate and enable interaction between domains, it is feasible and in fact desirable to introduce wave services that are automated top-down from customer relationship management to network infrastructure.

There are two dimensions of evolution, one is optimized solutions for satisfying the demand for transport capacity, and another dimension is to ensure streamlined repeatable automated operations. With the addition of customer portals and new commercial frameworks, managed wave services start to look nothing like what they used to look like in their past life.

We are about to see a lot of exciting offers at optical layer helping service providers to monetize their investments in optical networks.