When time is money, banks can’t afford a network outage

In the fast-paced world of Finance, success hinges upon the ability to foresee potential opportunities and challenges, while mitigating risk. “Always-on” access to advanced digital banking applications that enable banks to quickly move on opportunities, overcome challenges and manage risk, is critical.

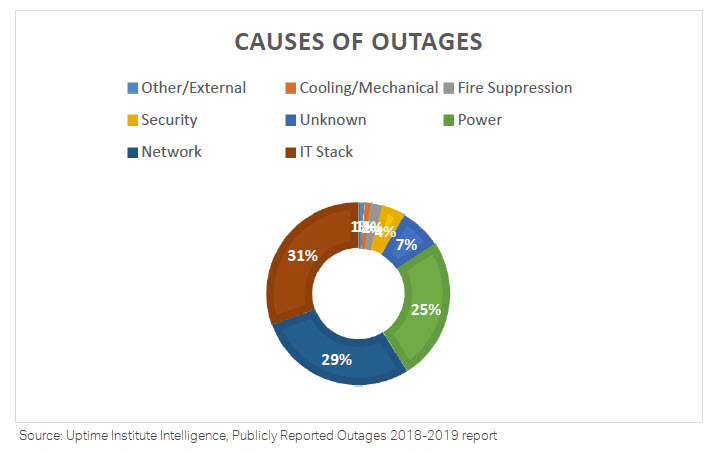

Unfortunately, these innovative new technologies are straining the IP/MPLS-based networks many banks deploy to connect their far-flung locations. Both unplanned and planned network outages are on the increase, causing significant losses. A recent Uptime Institute study reports that nearly a third of respondents reported outages over the past three years. The study also revealed that IT and network system and network issues were the primary causes of outages.

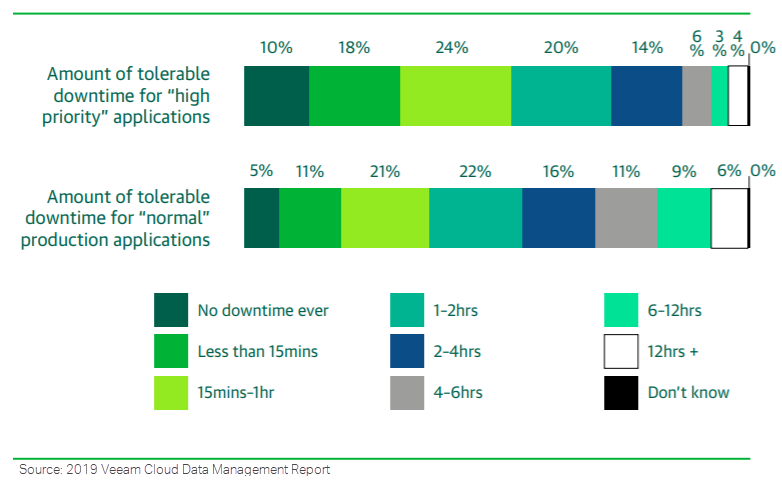

The consequences of outages are severe. A 2019 Veeam survey reveals the average cost of an outage for business-critical applications is $102K per hour, with estimated total annual downtime costs per respondent organization of $20M. Respondents also indicated that the amount of tolerable downtime for “high-priority” applications is less than one hour.

Banks build their customer relationships based on outstanding experiences and trust. When customers and staff cannot access the required content and applications, trust erodes, reputations suffer, and customers leave. When outages happen, network teams scramble to find out how and why they occurred while reassuring senior management that they won’t happen again.

Many banks rely upon IP/MPLS networks to connect their branches to data centers and cloud service providers. Major branches serve as concentration points, combining traffic from smaller branches before forwarding to the backbone network to reach data centers and cloud services. With the demanding performance requirements of new digital applications and the growing complexity of IP/MPLS networks, outages are a constant worry.

When outages do occur, even pinpointing the source can be an onerous task. Without the right tools, network teams lack the visibility needed to quickly troubleshoot and resolve the problem. Finding the root cause involves numerous hours manually analyzing events leading up to the outage and checking error and change logs for DNS servers, proxy servers and network devices.

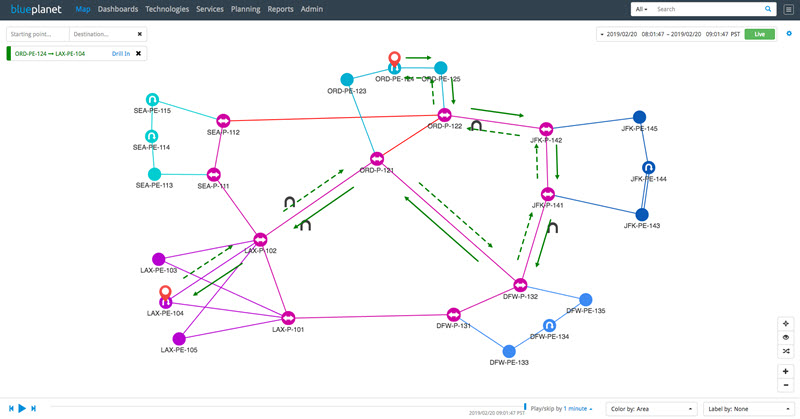

This no longer is the only option, Blue Planet Route Optimization and Assurance (ROA) product enables banks to quickly detect and resolve such outages and mitigate the risk of recurrence. They enable bank network teams to perform real-time monitoring and alerting of route, path and topology changes.

A “play-back” function provides a back-in-time forensic analysis of events leading up to outages. Interactive modeling of routing behavior enables network managers to evaluate “what-if” scenarios and take proactive steps to mitigate the risk of future outages.

ROA provides bank network teams the visibility into routing behavior of IGP and BGP protocols, MPLS VPNs and traffic engineering tunnels. Using ROA services banks can build and maintain real-time and historical topology models of the IP/MPLS network and overlay services. The models enable real-time monitoring and alerting of route, path and topology changes, providing back-in-time forensic analysis, and what-if modeling capabilities to mitigate the risk outages.

Banks invest billions of dollars each year to gain a competitive edge in financial transactions, develop winning investment strategies and minimize potential risk exposure. With the stakes so high, banks shouldn’t overlook a relatively simple step that can mitigate or avoid outages to the networks that customers and staff rely upon to succeed in the marketplace.