Things just got easier. Remove the guesswork and ensure your middle-mile network can deliver the broadband demands of tomorrow.

Broadband stimulus dollars are coming. With the establishment of the BEAD (Broadband Equity, Access & Deployment) program last year, out of the $65B allocated to rural broadband $42.5B of funds are earmarked for broadband infrastructure, which includes last and middle mile infrastructure, with an additional $1B of funds specifically allocated for Middle Mile infrastructure. In the “Infrastructure Funding Opportunities for Co-ops and the Communities they Serve” session at the NRECA TechAdvantage Expo in Nashville last week, it was outlined that “The new law opens up significant investment and funding opportunities for co-ops and the communities they serve.” Now, broadband offices in each state are tasked with coming up with a plan by the end of 2022 on how they will address (i.e which providers in each state) providing broadband to underserved communities.

How can we meet the growing demand?

While streaming video was becoming a trend in recent years, the pandemic accelerated this trend, with many consumers hunkered down at home. Whether streaming Netflix, Disney+, Apple TV or HBO Max, consumers binged-watched more content more frequently within various platforms, devices, and formats like 4K which requires the highest bandwidth capacity from a broadband connection. As a result, new streaming platforms like Disney+ grew their subscriber base from zero at the end of 2019 to 130M subscribers by the end of 2021. The truth is that amount of content being consumed over the network has changed forever.

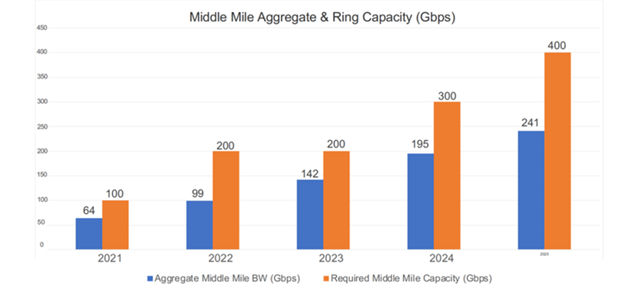

Having a scalable robust Middle-Mile infrastructure will be key to successfully building out broadband in rural areas. But how much bandwidth is needed in the middle mile to support expanded broadband access? Many last-mile vendors say that 100G is sufficient for the middle mile, yet this can be short-sighted. We worked with ACG Research last year to develop a middle mile bandwidth sizing model to look at this question in more detail and the results were quite striking. You can learn more about this middle-mile bandwidth sizing model in this ACG whitepaper.

ACG estimated middle-mile requirements by statistically multiplexing 20,000 households, the ‘average’ number of subscribers to broadband service providers, utility co-ops, and rural municipalities. Several other factors were considered when estimating middle-mile requirements such as broadband penetration, how hot does a provider want to run their middle network (75%), the percentage of households with 4K TVs (45%) and what percentage of the time these households are viewing 4K content (20%).

Here is their forecast for middle-mile capacity:

ACG, Middle Mile Networks Capacity Requirements for Fixed Broadband, 2022

This shows that over the course of 5 years, middle-mile utilization will rise to 241 Gbps and a middle-mile network will need to size for 400 Gbps to allow buffer capacity for mass events like the Superbowl and the Olympics.

But not every rural operator’s network fit into the averages above. How can a rural operator get an estimate of middle mile bandwidth requirements for their situation?

We developed an online “Middle Mile Capacity Forecast for Residential Broadband” tool with ACG to address this. To walk you through how to use the tool we created this short demo video below.

Broadband demand can quickly outpace the limits of your network, especially in today’s virtual-everything environment. The bottom line is 100G won't be enough. You’ll need a scalable and robust middle-mile, and this is a tool for all broadband providers to help you prepare.

The broadband stimulus dollars are coming to help communities get the bandwidth they need. Make sure you understand what your middle-mile network needs to meet your future requirements.